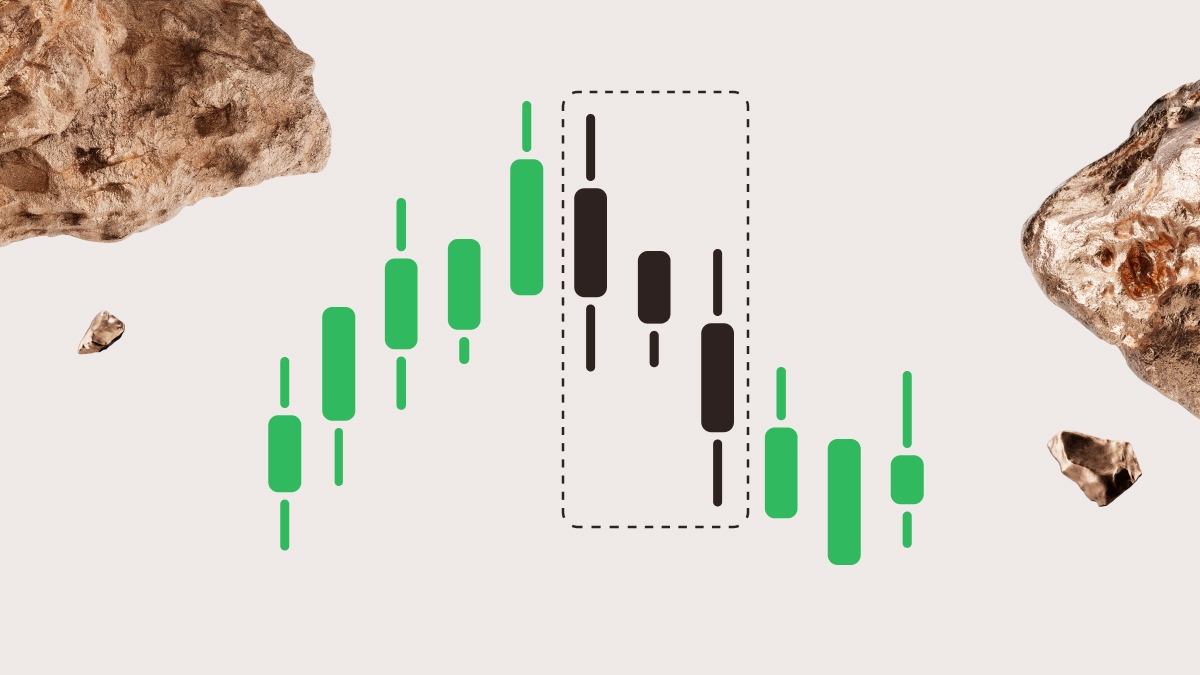

Bearish significance: why it signals a reversal

The Three Black Crows tell traders that buyers are no longer in charge. Bulls tried to keep the price up but failed three sessions in a row. Each close lower shows growing confidence among sellers.

When the pattern appears near a key resistance or major trendline, it can attract larger funds who see the shift early. The formation proves that bearish momentum is broad, not based on one candle. A chain of lower closes often marks the start of a deeper correction.

Traders read the pattern as evidence that buyers are overwhelmed, volume is shifting, and a downtrend may begin or an uptrend may pause. The signal acts as an early alert before indicators fully turn.

Why this matters:

Early warning. The pattern can show weakness before other tools flash bearish signs.

Volume confirmation. Higher volume across the three candles supports real selling, not profit-taking.

Risk clarity. The high of the first candle sets a clear place for a stop-loss.

Target planning. Traders can aim for the next support zone or a Fibonacci retracement for profit targets.

How to trade on the pattern

To trade on the Three Black Crows, treat the steps below as a checklist.

Context first

Check that the price has been rising or moving up sharply before the pattern forms. Look for major resistance, a round number, or an overbought RSI above seventy. A pattern that appears in the middle of a range is less reliable.

Volume check

Make sure volume grows from the first candle to the third. Rising volume shows real selling pressure. If volume stays flat or falls, the move may lack strength and fade quickly.

Confirmation tools

Add one more tool to confirm the shift. An RSI drop below fifty or an MACD bearish crossover both support the pattern. These tools help filter out weak signals.

Entry ideas

Choose the entry style that matches your risk tolerance.

Aggressive entry. Go short at the close of the third candle when both volume and a momentum tool confirm the shift.

Conservative entry. Wait for the price to break below the low of the third candle to prove follow-through.

- Pullback entry. Let the price return to the midpoint of the third candle and enter short only if it stalls or rejects that level.

Stops and targets

Plan your exits before you click the button.

Stop-loss. Place the stop just above the high of the first crow to cap risk on a failed pattern.

Take-profit. Aim first for the nearest support zone or the 0.618 Fibonacci retracement of the prior rise. A fixed risk-to-reward of 1 to 2 also keeps the plan clear.

Trailing rule. After the price moves by the same distance as your initial risk, that is, it gains the amount you were prepared to lose, move the stop to breakeven (your entry price) or trail it above each new lower high to lock in gains.

Extra Filters

Avoid taking the setup just before major news because spreads can widen. Skip thin sessions such as the early Asia open. Keep a trade log to learn which entry style and filters work best for you.

Example of the pattern in real charts

To see the pattern in action, look at a recent USDJPY four-hour chart. The price had climbed for days and stalled near a round number. The RSI moved above 70, showing an overbought market. Then three long bearish candles printed, each closing lower with almost no wicks.

A Fibonacci retracement from 142.356 up to 148.652 showed the 0.618 level near 144.761. Rising volume across the three candles confirmed real selling. When RSI slipped back under 70, a short trade opened at the next candle’s start. The stop-loss was placed just above 148.652, marking the top of the pattern.

Two sessions later the price touched 144.761, giving a clear one-to-two risk-reward result. The setup merged an overbought RSI, strong red candles, rising volume, and Fibonacci alignment for a well-defined trade.

Limitations and pitfalls to watch for

The Three Black Crows can mislead in a low-volume or slow market. The pattern may show up during a brief pullback inside a larger uptrend and fail soon after. If trading activity is light, sellers may not have enough force to push the price lower. Sudden news can also break the pattern minutes after it forms.