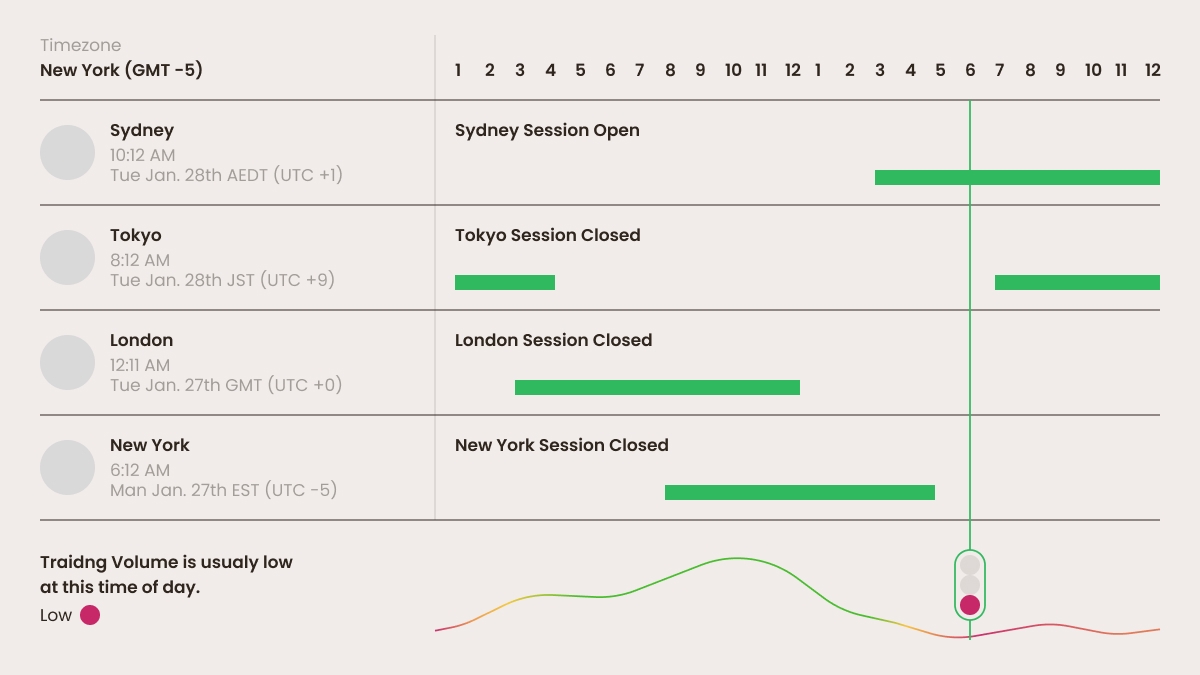

The Forex market sessions

The Forex market operates 24 hours a day, five days a week. Traders can take advantage of the different time zones and the way their sessions overlap. Here’s a basic outline of the main trading sessions and their business hours in Greenwich Mean Time (GMT):

Sydney session

Opens at 10:00 PM GMT

Closes at 7:00 AM GMT

Tokyo session

Opens at 12:00 AM GMT

Closes at 9:00 AM GMT

London session

Opens at 8:00 AM GMT

Closes at 5:00 PM GMT

New York session

Opens at 1:00 PM GMT

Closes at 10:00 PM GMT