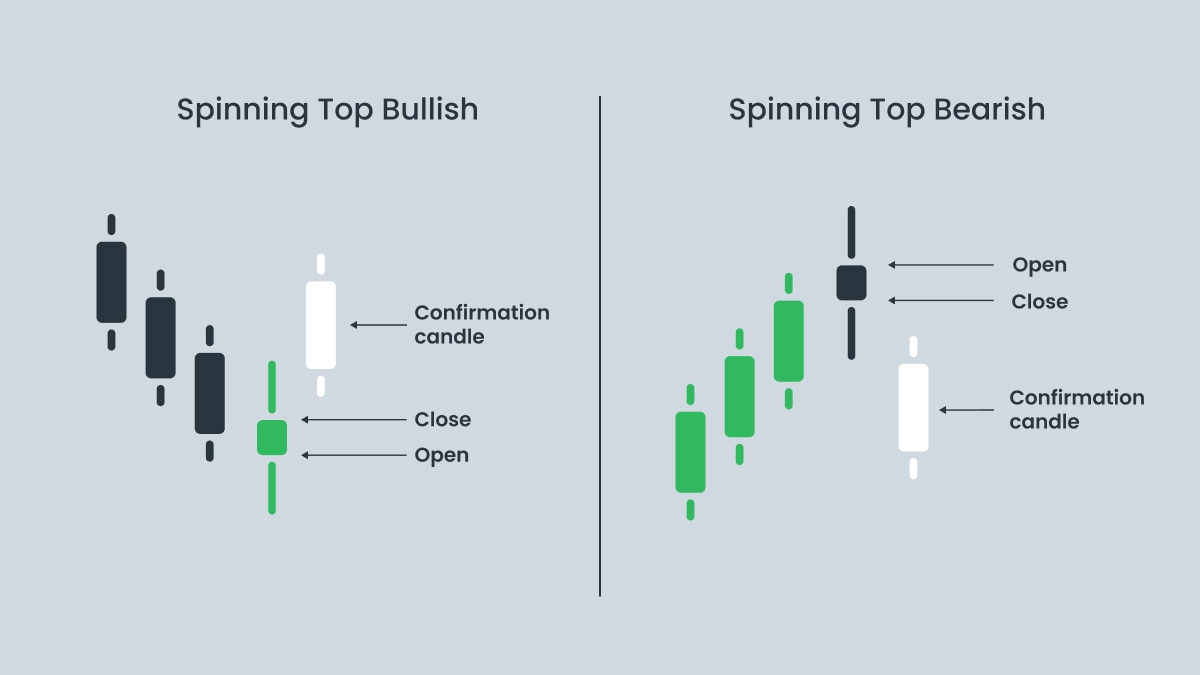

Both patterns look nearly the same. They have the same size body and the same long wicks. The body’s color doesn’t carry much weight unless the next candle gives you some type of confirmation.

Spinning Tops vs other candlestick patterns

A common mistake is mistaking Spinning Tops for Doji candles. At first glance, they look similar, and they both show indecision. But the meaning and structure are different.

A Spinning Top is like a balanced tug-of-war where both teams pull the price into their territory but can’t hold it and end back near the start. All it shows is hesitation, unless a reversal is confirmed. Their bodies sit right in the middle of their range, and both of their wicks are long and of equal length. That makes them neutral. They need something else to confirm where the market is headed, such as the next candle or a support or resistance level.

A Doji candle , on the other hand, shows total indecision, as if no team pulled it anywhere. If this forms after a strong trend, it can signal a potential reversal.

| | Spinning Top | Doji candle |

| Real body | Small, but visible and colored | Tiny or nonexistent (open ≈ close) |

| Shadows/wicks | Long upper and lower wicks | They can vary (long, short, or no wicks) |

| Market message | Indecision, slight effort from both sides | Total deadlock, no clear control |

| Trend context | Often in consolidations or pauses | Stronger after a trend (signals exhaustion) |

| Signal strength | Weak, requires context and confirmation | Strong, potential reversal signal, especially post-trend |

| Confusion risk | Commonly mistaken for Doji | Mistaken as “spinning top with no color” |

Spinning Tops can also be mistaken for Hammers, Inverted Hammers, and Shooting Stars. Those have different meanings.

A Hammer has a small body at the top and a long lower wick. It forms after a downtrend and can signal a bounce. It means the price fell hard, but buyers pushed the candle’s body back up.

An Inverted Hammer is the opposite. It forms after an uptrend and has a small body near the bottom with a long upper wick.

A Shooting Star is basically an inverted hammer that forms after an uptrend rather than a downtrend. This can signal that the price has reached a top.

How to trade the Spinning Top pattern

Seeing a Spinning Top doesn’t mean it’s time to hit the buy or sell button. On its own, it’s just a pause. What makes it useful is the context it forms in. When it aligns with key technical tools like the Fibonacci retracement, a trendline, or the RSI, it can turn into a strong setup.

One of the most reliable strategies is to trade Spinning Tops that form near overbought or oversold RSI signals, while using major Fibonacci levels to time entries and exits, such as the 0.0% swing high and retracements like 38.2% and 61.8%.

Example: Spinning Top + Fibonacci + RSI on the USDJPY 4-hour chart

In this example, the USDJPY pair rallies and reaches the 0.0% Fibonacci level, forming a top at the resistance level. That’s the first signal.

A Spinning Top forms, signalling hesitation. This is your second signal.

We can see that the RSI is above 70, which means the pair is overbought, and the volume is dropping, which is another warning sign that momentum is fading. This is the third signal.

The next candle is red and breaks past the Spinning Top’s low. This is your confirmation signal, and can be your entry for a short trade.

Trade setup example:

Entry: Below the Spinning Top’s low.

Stop-loss: Above the Spinning Top’s high wick.

Take-profit: Fibonacci 38.2% retracement or nearest support level.

Trading with two or three confirmation signals can increase the probability that your setup is solid. Below is a list of strong confirmation signals to look out for when trying to trade Spinning Tops:

Break past the Spinning Top’s high or low

Trendlines

Overbought or oversold RSI

MACD crossing or diverging

Volume spike or drop

Fibonacci retracement or projection levels

Support and resistance levels

Taking screenshots when you trade Spinning Tops can be a helpful exercise. Over time, you’ll notice which conditions make them work and which ones don’t. The most reliable Spinning Tops tend to show up after extended moves. If the market’s been climbing for days and then you see a Spinning Top, that’s more meaningful than if you see one right after a random two-candle bounce. Also consider zooming out. A Spinning Top on the 1-hour chart that lines up with a support level on the daily chart gives you a lot more confidence than one floating in the middle of nowhere.