Karena sekarang sebagian besar keuangan kita dilakukan secara online, sering kali hanya dengan menggunakan ponsel, bayak pelaku kejahatan yang berusaha mencuri uang kita. Setelah membaca artikel ini, Anda akan mempelajari:

Cara mengenali serangan.

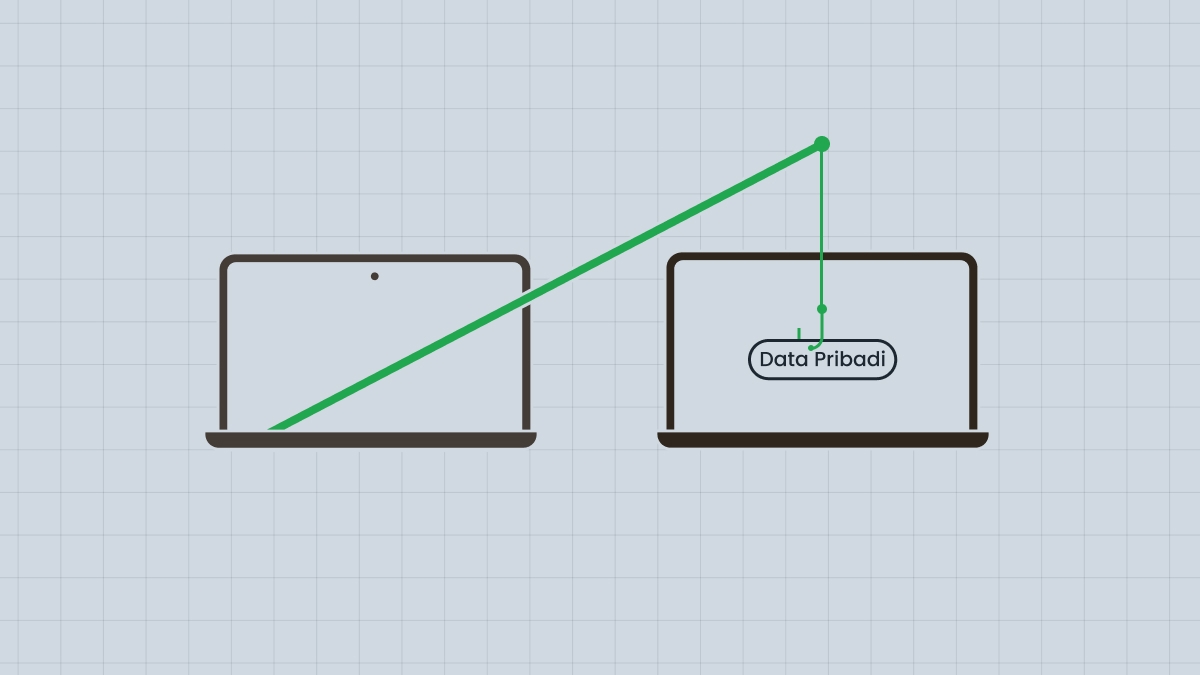

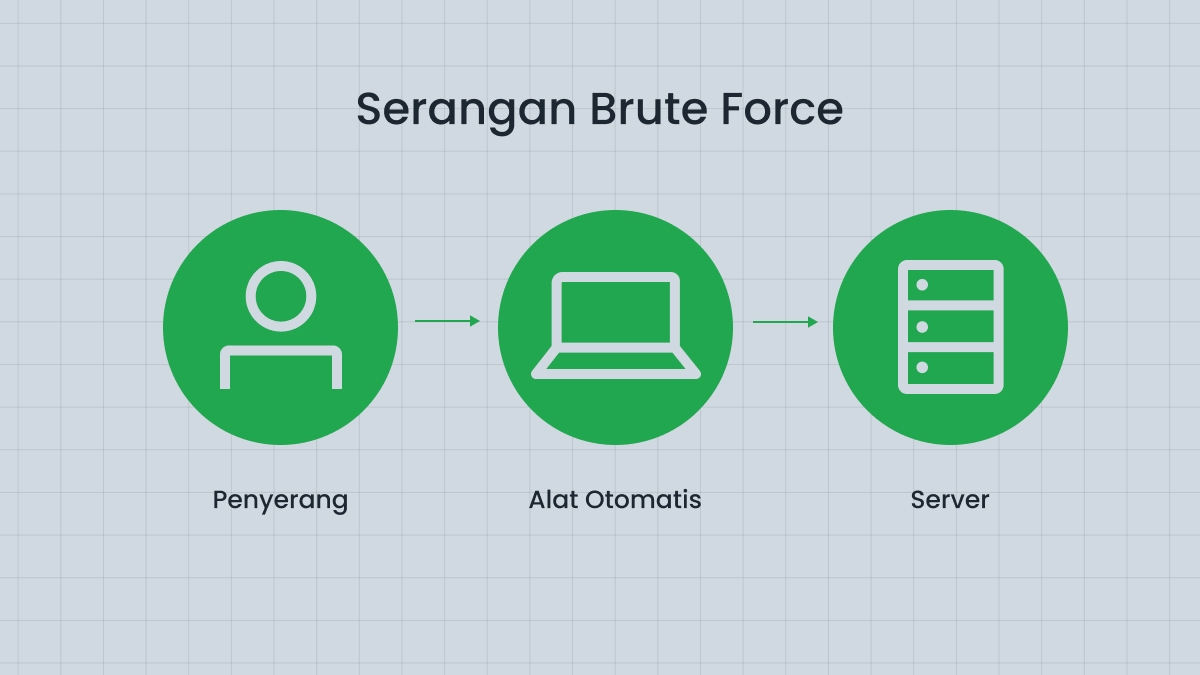

Metode yang digunakan peretas untuk mencuri data.

Cara melindungi akun Anda dari peretas.

Hal yang harus dilakukan jika Anda menjadi korban peretas.

Cara mengenali serangan

Anda mungkin pernah menerima pesan dari seorang teman yang meminta untuk meminjam uang, dan ternyata akun teman tersebut di Telegram atau WhatsApp telah dibobol. Meskipun semua penyedia layanan keuangan, termasuk broker online, menggunakan alat perlindungan akun canggih, tetap penting bagi pengguna untuk belajar mengenali serangan saat menjadi target.

Aturan umum adalah selalu mencurigai penipuan setiap kali terjadi hal yang tidak biasa.

Anda menerima email atau pesan yang meminta Anda mengklik tautan atau membuka lampiran.

Seseorang atau perusahaan memilih cara komunikasi yang tidak biasa dengan Anda. Misalnya, Anda menerima pesan dari teman di Telegram padahal biasanya Anda berdua berbicara lewat WhatsApp.

Anda diminta memperbarui informasi keuangan. Anda mungkin ditekan untuk melakukannya sekarang juga. Rasa urgensi adalah trik umum yang digunakan penipu.

Anda ditawari sejumlah uang (bonus, pengembalian dana, dll.), tetapi harus memberikan beberapa data terlebih dahulu untuk menerimanya.

Email yang tidak menyebutkan nama Anda, melainkan menggunakan sapaan umum, seperti “Halo sayang”.