- Forward guidance: Chair Powell and most policymakers emphasize a data-dependent approach, noting rising inflation risks from tariffs and divergent views within the committee regarding rate cuts.

Economic Landscape: Inflation, Labor & Growth Divergence

- Inflation pressures persist: Recent CPI and PCE data show annualized inflation near 3.5%, well above the Fed's 2% goal, with heightened risk from incoming tariff-related price increases and persistent wage growth.

- Labor market strength persists: Unemployment remains around 4.2%, while wage gains outpace core inflation, reinforcing the notion of labor-driven inflation pressure.

- Growth signals mixed: Q2 GDP is expected to bounce around 2.5% following a Q1 contraction, but signs of slower labor demand and weak housing persist, factors weighing on policy considerations.

Internal Debate: Authority vs. Pressures

- Political dynamics: President Trump continues to vocally pressure for immediate rate cuts. Two Fed appointees, Governors Bowman and Waller, signal support for easing. However, the broader FOMC consensus favors delaying cuts until data clearly justify them.

- Dissent potential: While no dissent occurred in June, upcoming debates may turn contentious, especially if growth disappoints. The majority still advocates holding rates to guard against inflation risks triggered by tariffs and fiscal stimulus.

Projections & Market Expectations

- Future guidance: JPMorgan's mid-June summary shows no dissent and projections for core PCE inflation at 3.1% in 2025, declining to ~2.1% by 2027; unemployment projected to rise to 4.5% in 2025–26; growth revised to ~1.4%–1.6% through 2026.

- Rate cut timing: Markets now favor a September cut, with a ~70% probability priced in; expectations for multiple cuts this year have moderated, referring to one or two by year-end if inflation slows convincingly.

Policy Scenarios & Implications

- Hold (Base Case): July hold is likely. Chair Powell will highlight labor-market resilience, tariff cost pass-throughs, and inflation risks. Markets should align around a cautious tone.

- Dissent but no cut: Some hawkish Fed members may push for earlier cuts, but a broader narrative of caution suggests no immediate easing. Comments will shape September expectations.

- Clear inflation signals: If upcoming CPI/PCE or labor data show significant cooling, the Fed could adjust dot plot projections or tone toward cuts in September or December.

Implications:

- Economic: Holding rates supports continued restraint amidst tight labor markets and inflation uncertainty.

- Markets: Expect initial volatility around the dot plot release and Powell's press briefing; dovish tones could weaken the dollar, and risk assets may rally.

- Policy divergence: With the ECB already easing and global trade dynamics shifting, continued Fed restraint maintains yield differentials favoring USD, keeping EURUSD under pressure.

Conclusion: Despite internal debate and political pressure, the FOMC is on track to hold rates at its July meeting. Chair Powell's data-centric approach and stubborn inflation and wage growth support patience. Markets now watch for subtle cues that could shift expectations toward a September rate cut, contingent on incoming economic data and inflation trends.

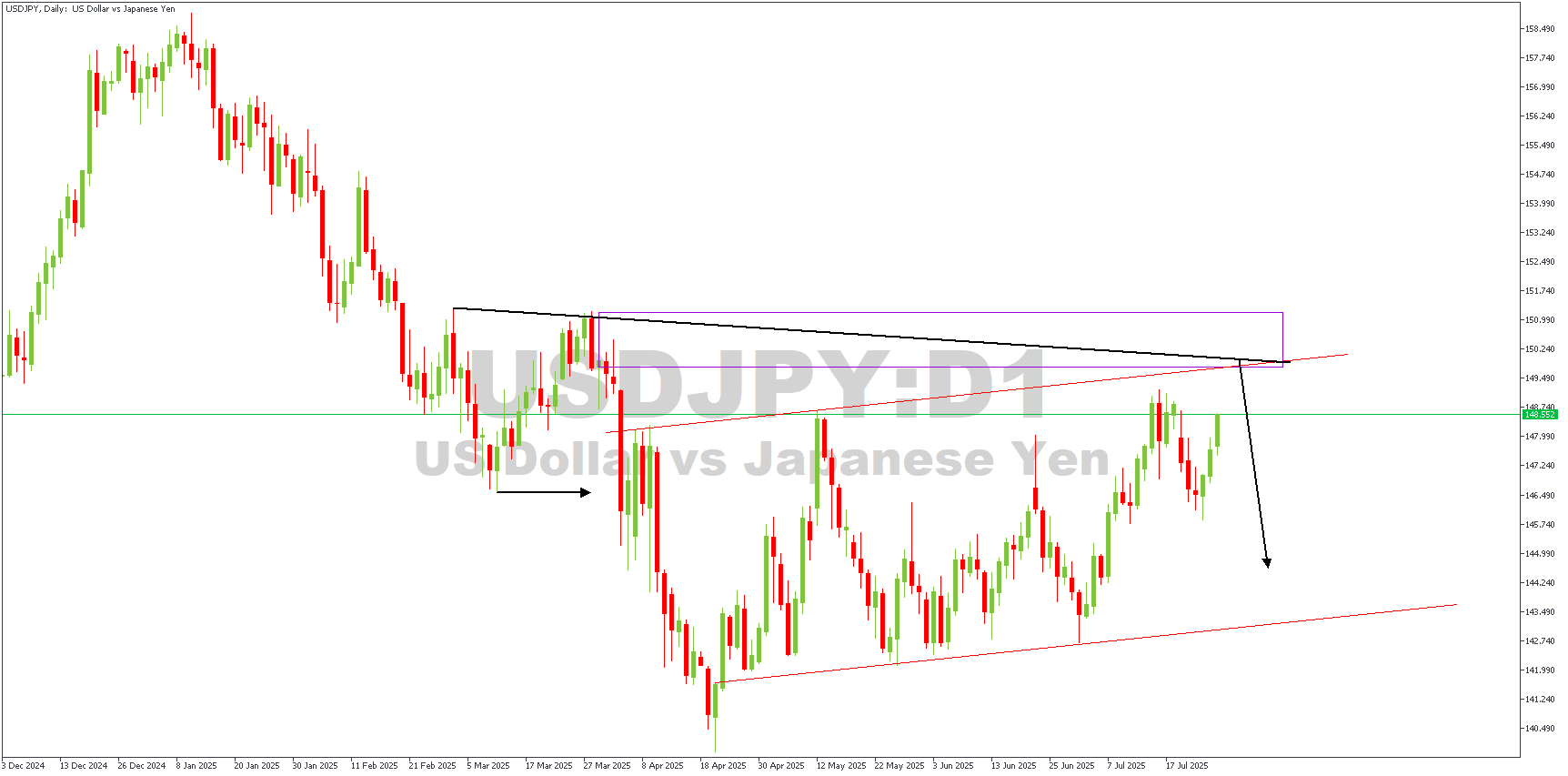

USDJPY – D1 Timeframe

On this USDJPY Daily chart:

Price has been in a broader downtrend since late 2024, forming lower highs and lower lows, with a clear descending trendline acting as resistance.

The black arrow highlights a breakout from a short-term consolidation zone, which eventually failed to push price above the upper trendline.

Now, price is approaching a confluence zone, where the descending trendline and the upper boundary of a rising wedge pattern intersect, also near a previous supply area (highlighted in purple).

The current analysis anticipates that this area will act as strong resistance, with the black arrow projecting a bearish rejection from this zone.

If sellers step in here, price may begin a new downward leg toward the lower boundary of the wedge or even break lower if momentum is strong.

My Trading Plan:

I'll closely watch the 149.80–150.20 region to see how price behaves.

I'll look for short opportunities if price shows strong bearish reversal signs (like a shooting star, bearish engulfing, or strong rejection wick).

Stop loss would go just above the purple supply box, while the first target would be near the wedge's lower boundary around 143.00.

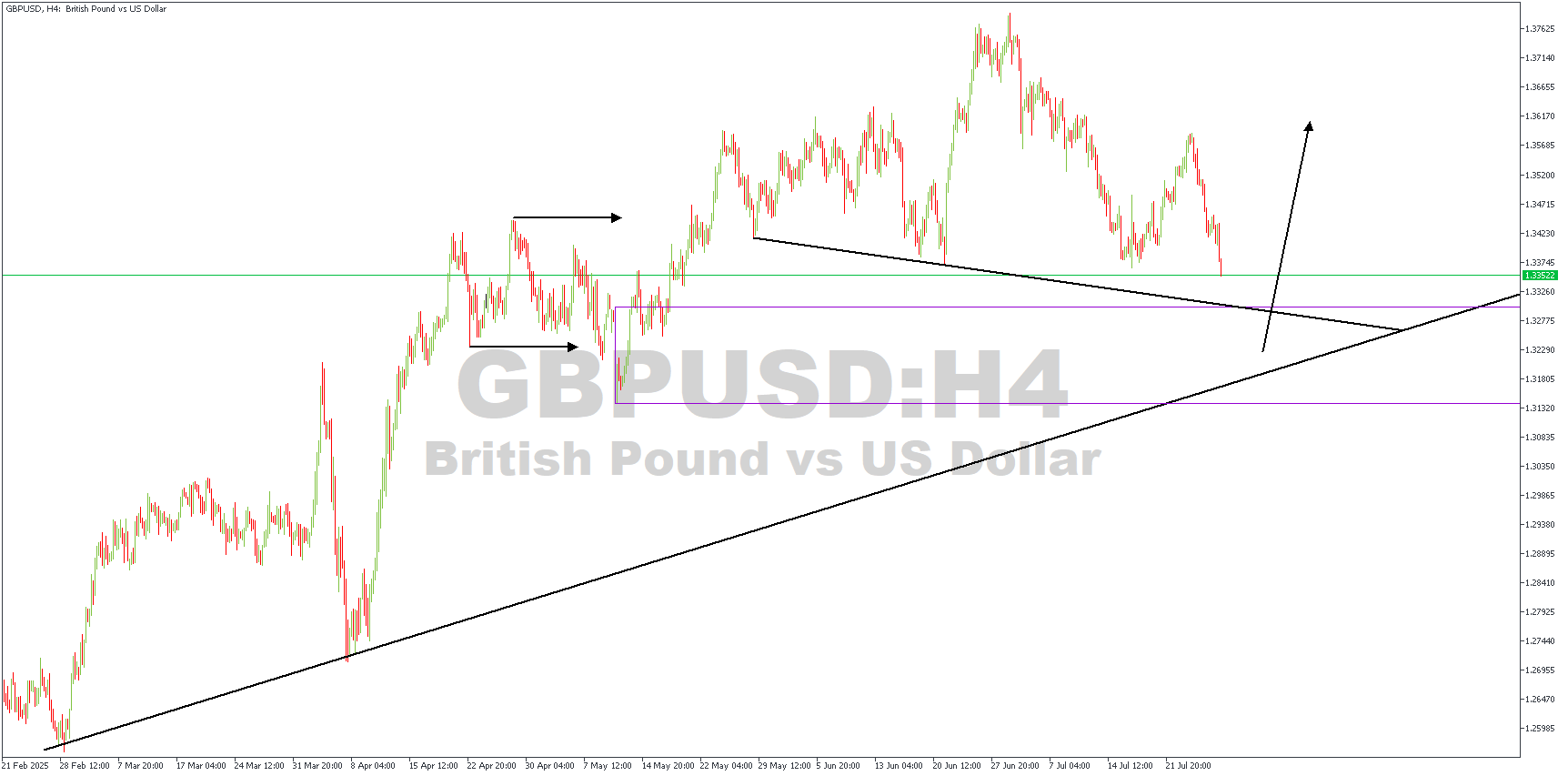

GBPUSD – H4 Timeframe

On this GBPUSD 4-hour chart:

Prices have been in an overall uptrend, making higher lows since late February 2025, supported by a long-term ascending trendline.

A period of sideways movement (highlighted with arrows) formed a consolidation range, which was eventually broken to the upside, suggesting renewed bullish interest.

Price then pushed higher but is currently undergoing a correction, retracing back toward a key confluence area where two trendlines intersect — one descending (short-term structure) and one ascending (long-term trendline).

This intersection zone is a strong technical support, and the upward arrow indicates a potential bounce, signaling the continuation of the broader uptrend.

If price respects this support and forms a bullish reaction (like a rejection wick or bullish engulfing), buyers may re-enter to push the pair toward the previous highs.

My Trading Plan:

I'll monitor how price behaves around the 1.3250–1.3300 zone, especially where the trendlines cross.

A strong bullish candle from this region would confirm interest from buyers and offer a buying opportunity.

Stops can be placed just below the trendline, with targets near 1.3700 for a favorable risk-to-reward setup.

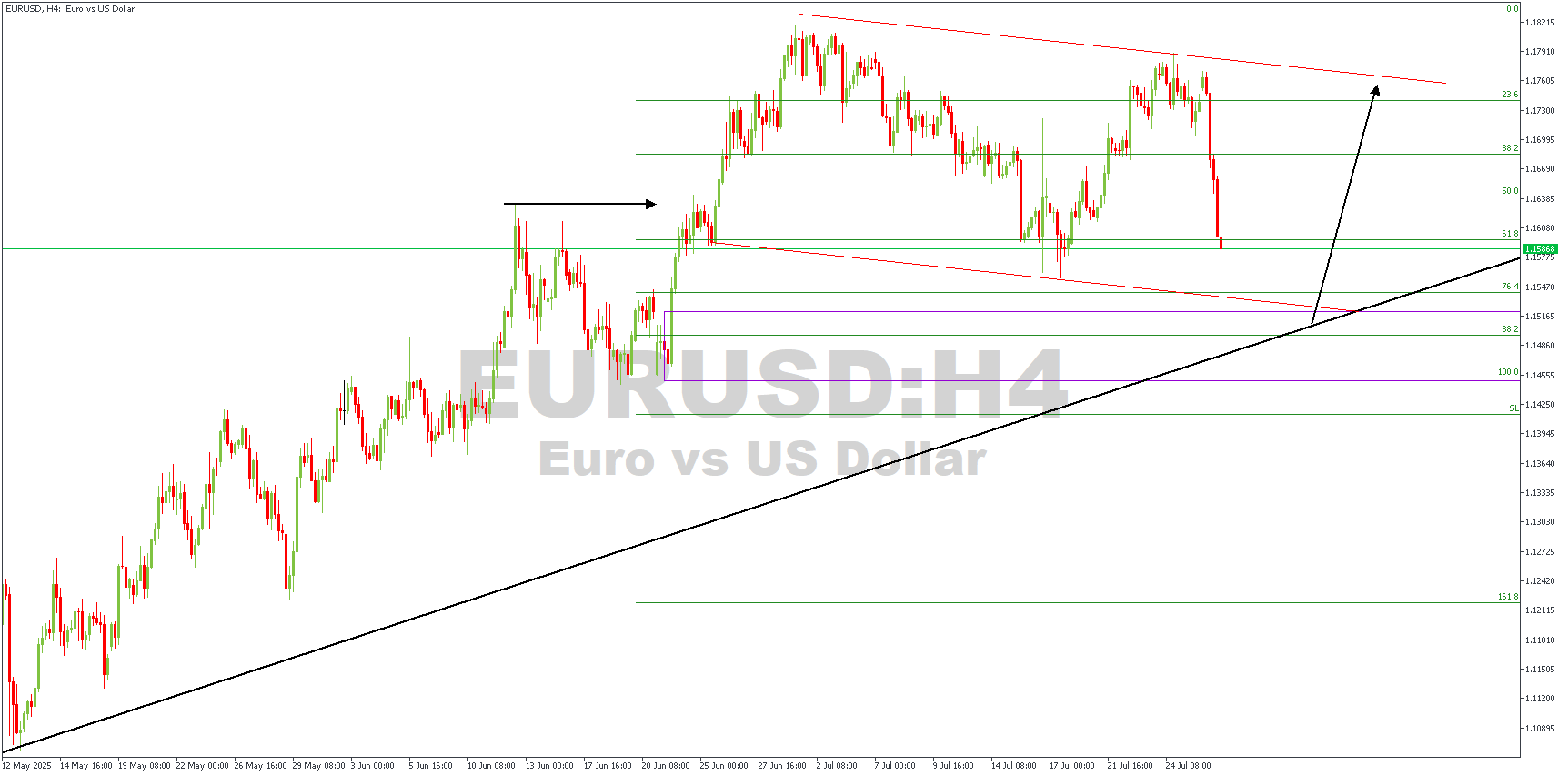

EURUSD – H4 Timeframe

On this EURUSD 4-hour chart:

Price recently rejected the 1.1820 area and is now retracing sharply, testing the 61.8% Fibonacci level near 1.1586.

A broad descending wedge (marked by red lines) is forming, with price compressing toward the wedge's lower boundary and long-term rising trendline support.

This rising trendline has guided the uptrend since mid-May and is now aligning with the 76.4% and 88.2% Fibonacci retracement zones, adding strength to this support area.

The black arrow suggests a possible bullish bounce if price finds support near the wedge bottom and resumes the prior uptrend.

A break above the wedge's upper boundary could unlock a move back toward the recent highs around 1.1820.

My Trading Plan:

I'll watch for a bullish price action signal (e.g., a pin bar or engulfing candle) around 1.1540–1.1580, where the wedge support and trendline intersect.

If buyers step in firmly, I'll look to go long, aiming for a move toward the 1.1760–1.1800 resistance area.

However, if price breaks below the trendline, I'll stand aside and reassess for a deeper retracement.

Direction- Bullish

Target- 1.16863

Invalidation- 1.14373

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.