What are the types of operational risk?

Now that we have covered the four causes, let’s have a look at seven different types of operational risk that they can be broken down into.

Internal fraud. Employees intentionally and secretly misappropriate company resources. It is up to management to establish proper checks.

External fraud. An external party attempts to steal company resources or property. This can be hackers stealing money or competition stealing intellectual property.

Technology failures. A company’s software and computer systems fail.

Process management. Those in charge fail to develop the proper response to a problem or fail to implement their strategy.

Workplace safety. A company violates safety regulations or fails to protect its employees from physical or mental harm.

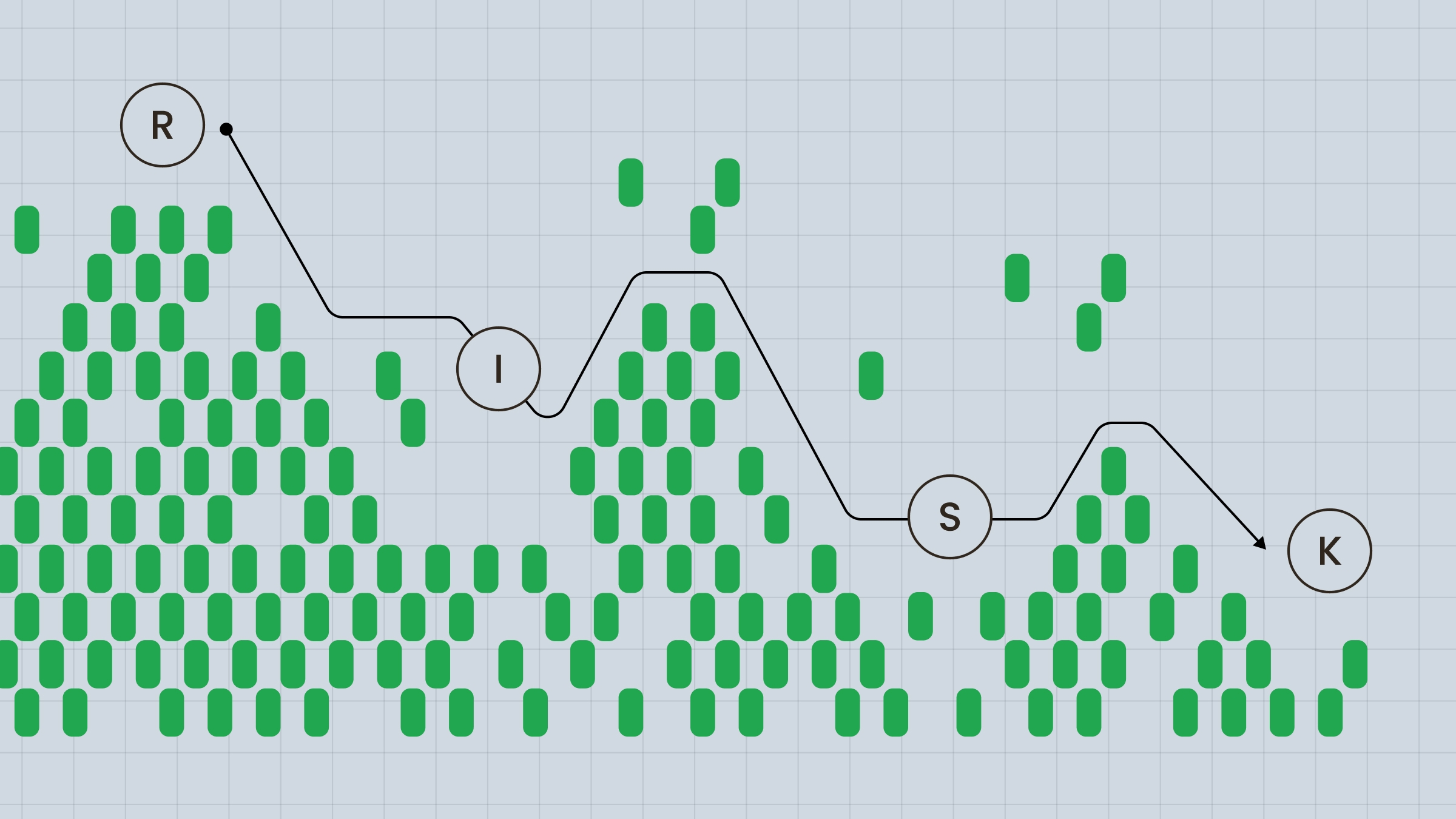

Damage. External factors like weather or natural disasters impact company supplies or production, or the ability of employees to do their job. A fire or flash flood can disrupt a supply chain. A snowstorm could prevent people from reaching their workplace. American food chain Waffle House is an example of a company that has great disaster preparation, as it is known for staying open all day, every day of the year, except in extremely bad conditions. There is even a metric called the Waffle House Index used to measure how bad a storm is.

Clients. A company harms its clients by providing false information, faulty products, not abiding by the law, or failing to meet requirements.

Other types of risks

Let’s go over how operational risk compares to financial, market, and strategic risk.

Market risk refers to the risk of losses associated with changes in market prices, like stocks, interest rates, and currency rates. Stock prices can be directly related to market sentiment. Investors will feel a certain way about a company and its stock and options prices: is it overvalued or at a discount? Is sentiment bullish or bearish? Market risk is also related to changes in interest rates, as these will have an effect on how much it costs for companies to borrow money. Changes in currency rates, the price of raw materials, and other economic factors also come into play here.

Credit risk refers to the risk of financial loss a company will face when it no longer has enough money to pay off its loans and debt. While this could be related to poor management and bad sales, financial risk is different from operational risk because it has to do with a company’s financial health rather than how it runs its operations on a daily basis.

Strategic risk relates to a company’s strategy and objectives in the long term. It comes from a company’s failure to adapt to new regulations, for example, or investing too much in a sector that doesn’t end up growing. It is linked to operational risk in the sense that operational risk is the risk of failure encountered while trying to implement this strategy. The operational human or systems errors have a more immediate impact.