ETPs are getting more and more popular with retail and institutional investors because they make accessing diverse markets easier. But what are they?

Here’s how they work.

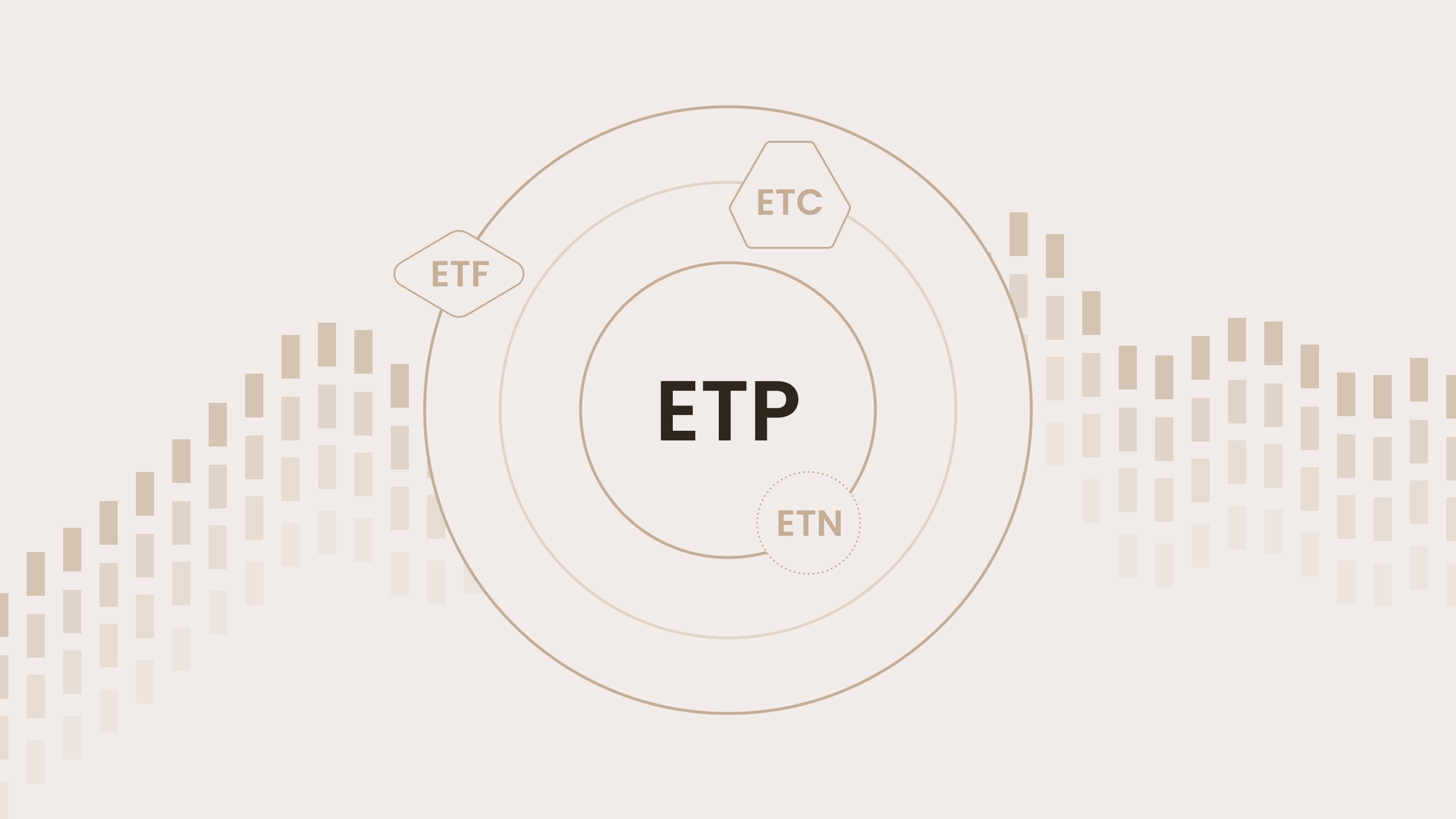

The basics of Exchange-Traded Products

An Exchange-Traded Product is an investment security that can be bought and sold on a stock exchange. It’s basically a really streamlined way to invest in a bunch of different stuff. They track the performance of indices, commodities, bonds, or currencies. Want to invest in gold, but don’t have anywhere to store it? Get a gold-focused ETP and treat it just like a gold investment, getting exposure to all the market moves the yellow metal makes.

.jpg)