July 07, 2025

Basics

What Are Mutual Funds?

Mutual funds are companies that pool money from investors and use the total sum to make diversified investments. They are SEC-registered and run by professional money managers who decide which assets to buy and sell.

How mutual funds work

When you invest in a mutual fund, you give them your money and they invest it on your behalf. They build a diversified portfolio made up of different assets — stocks, bonds, and other securities. When investors buy shares of the fund, they’re buying partial ownership of the fund’s portfolio. The share price of a mutual fund, known as the Net Asset Value (NAV), is calculated at the end of each trading day. It consists of the total value of the fund’s assets (stocks, bonds, cash, and other securities) minus costs (expenses and management fees), divided by the number of shares:

NAV = (ASSETS - COSTS) / NUMBER OF SHARES

How to invest in mutual funds

Mutual funds aren’t bought and sold between traders on an exchange like stocks and options. Instead, they are bought and sold directly through the fund. This can be done through its website, but also with the help of a broker and an investment adviser. You can buy and sell them at the new daily NAV price.

What are the types of mutual funds?

There are many different types of mutual funds, which is great because every trader’s investment goals and risk tolerance are unique to them.

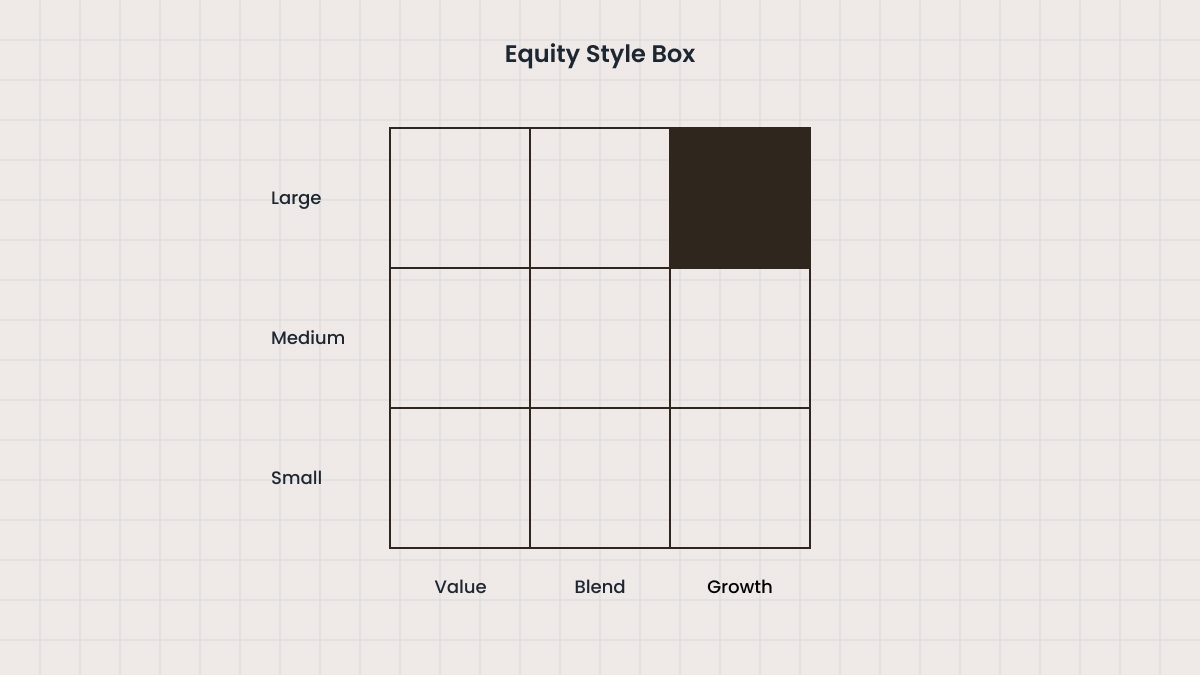

Equity funds, also known as stock funds, invest in US or foreign stocks and equities, and can vary greatly depending on their strategy. They can focus on small, mid, or large-cap companies. They can also focus on growth, income, or value. Depending on their strategy and the stocks they own, these funds can vary in their diversification and risk. If the stocks they invest in go up, so does the fund’s value. The opposite, of course, is also true.

Fixed income funds are also known as bond funds. Their goal is limited risk and a steady flow of income. They achieve this by investing in government and corporate bonds that pay a regular, fixed interest. Some of these funds focus on a specific type of bond, while others invest in a mix. These funds will vary in risk, return, and volatility. Investors can therefore choose those that fit their investment goals.

Target-date funds are designed for retirement planning. These funds invest in a mix of different assets like stocks and bonds. As time passes, they adjust their portfolio. The closer they get to the specific target retirement year, the more they shift from risk to stability. This means dropping growth-oriented strategies in favor of more conservative ones like bonds and cash. Doing so offers more protection from market swings at a time in your life when taking risks isn’t the best idea.

Money-market funds typically focus on safer, low-risk, and short-term investments. The flip side is that these offer more modest returns. That’s why investors usually put their money in them instead of a classic savings account or cash. It’s often a temporary solution for storing money that isn’t being used yet. While these funds tend to offer slightly better returns than a savings account, they aren’t insured by the Federal Deposit Insurance Corp (FDIC), which makes them riskier.

Index funds are very common and are designed to track the performance of a specific index, such as the S&P 500, the Dow Jones Industrial Average, or the NASDAQ. Unlike actively managed funds, these are managed passively. Since they mirror the performance of the index rather than trying to outperform it, they are easier to run, incurring lower fees. They also tend to outperform actively managed funds in the long run. This makes them a prime choice for investors.

What are the benefits of mutual funds?

Mutual funds are a convenient and relatively straightforward solution for investors who don’t have the time to research stocks or actively trade and manage their portfolios. They are affordable, provide diversification, and can generate passive income.

Diversification and professional management

Since they are actively run by professional managers, you can sit back and relax. Your money is managed by qualified individuals with expertise and technological resources that allow them to analyze the market and make informed decisions, diversifying your portfolio with stocks, bonds, and other securities. Diversification means more protection from risk. The more you diversify, the more your investment will be positioned to withstand downturns in a certain stock or asset category. If stocks go down but bonds go up, for example, the rise of one can cancel out the decline of the other. Mutual funds will also give you regular updates on how they performed, keeping you in the loop and being transparent with how your money is managed.

Affordability and liquidity

The required minimal investment can in some cases be under $100, meaning you don’t have to invest the large quantities of money that you would normally to achieve the same diversification on your own. It’s like going to a pizzeria and getting a single slice instead of a whole pie, and it's up to you to decide how big or small you want that piece to be. Mutual funds also provide liquidity, since you can buy or sell your shares at the fund’s NAV on any business day.

You may incur fewer transaction costs than you would trading as an individual investor because mutual funds buy and sell much bigger amounts at a time, making them a cost-effective way to invest. Fees and additional costs required to run the fund could, however, impact your investment.

Earning money

Mutual funds can generate money for you in different ways. They can earn regular dividends from stocks or interest from bonds and redistribute them to their shareholders as a dividend, minus expenses. Shareholders can then choose to pocket the money or reinvest it directly into the fund to buy more shares. Mutual funds can also generate capital gains by selling securities at a profit and redistributing them to shareholders at the end of the year, minus capital losses. Finally, if the fund’s portfolio increases in value after expenses, the NAV of its shares will also increase. Shareholders then own shares that are worth more than the price they paid for them.

What to consider before investing

Know your fund

To find a mutual fund that aligns with your investing goals, it’s worth your while to do a little research first. You can find ratings by independent third-party organizations online.

Mutual funds also provide prospectuses and shareholder reports for free on their websites and the SEC website.

You can read these to understand exactly how the fund works. It will also give you information on how much it costs and how your money is managed and invested. If there’s something you don’t understand, ask them about it. You’re essentially entrusting your money to someone else, so it’s important to understand what’s being done with it.

Fees & taxes

Investing in a mutual fund isn’t free. Make sure you understand exactly how much it will cost you. For example, some funds will charge you fees when you buy and sell shares or when you sell them too early. You might also pay for expenses related to running the fund. Sometimes, these are deducted from the fund’s NAV. So while you don’t pay for them directly, you still do, and in the long run it will affect how much money you make. Fees can seem insignificant, but they can have a big negative impact on your investment long-term. Mutual funds will also pass down taxes from dividends and capital gains to shareholders. Some mutual funds are more tax-friendly than others, so it’s a good idea to check.

Risks

Investing in a mutual fund is on the safer and easier side of the trading spectrum. However, it does bear its own kinds of risks. The fees and taxes could potentially impact your returns over time, so it’s worth reading up on them. Another thing you should keep in mind is that mutual funds aren’t guaranteed by the FDIC. This means your money isn’t protected from market volatility or poor fund management. If the stocks the fund owns depreciate, so will your investment. In rare instances of financial crisis or market crashes, some funds may also pause withdrawals until things settle to protect themselves and their investors. This can limit how quickly you can take your money out. Management is also important, and your investment can quickly become worthless if a fund is poorly managed. Dividends and interest payments are not set in stone and can change along with market conditions. What was once a good source of passive income can become a better one, but it can also deteriorate.