Out of the money (OTM), at the money (ATM), and in the money (ITM) options

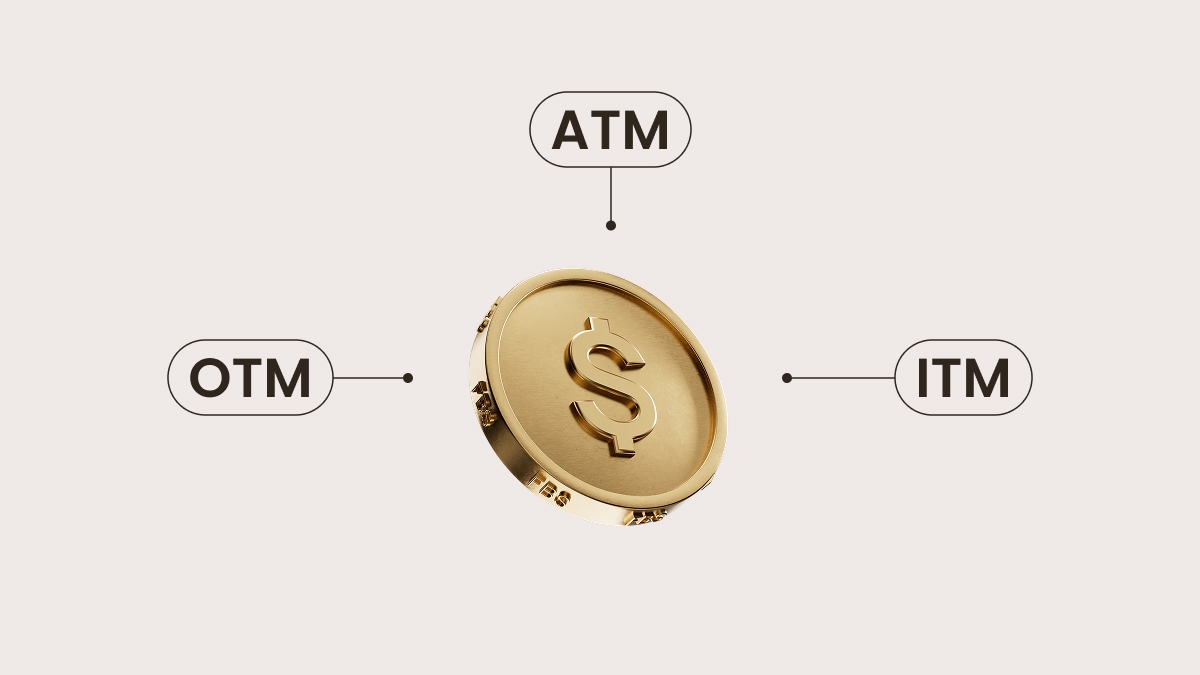

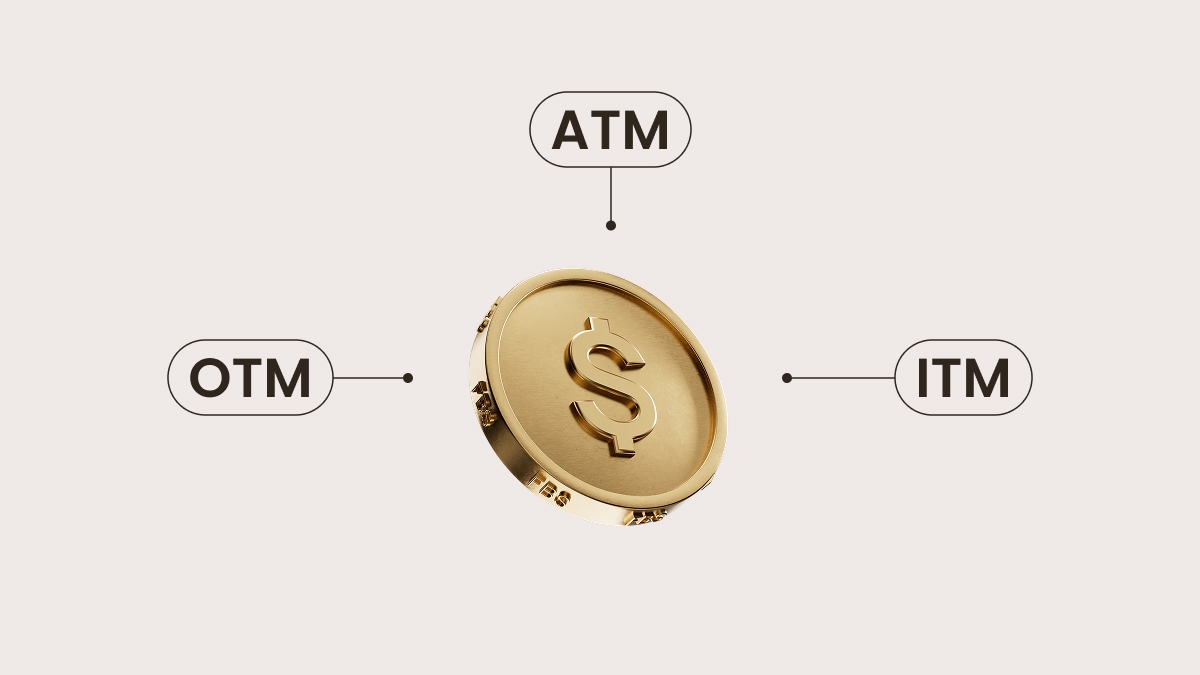

One of the terms associated with options is “moneyness.” There are three ways to describe an option’s moneyness:

Out of the money (OTM) options are options for an asset that has not yet reached its strike price. These options have no intrinsic value and are made up exclusively of extrinsic value. They are not yet profitable, so they are riskier and therefore less expensive than ATM and ITM options that have the same expiration date. The more time you have until expiration, the more expensive the option will be because more time means more opportunities for the stock to reach the strike price. If the option expires out of the money, the contract will be worthless, and the buyer will lose the premium they paid for the option.

At the money (ATM) options are options with a strike price that is the same as the current market price. This type of option is very close to having intrinsic value, and is about to become profitable if the stock price continues in the desired direction. The stock must move enough to make up for what you paid for the premium.

In the money (ITM) options are options for assets that have already surpassed the strike price. These have both intrinsic and extrinsic value and are therefore more expensive. ITM options are profitable upon expiration if you are in the money by more than what you paid for the premium.

Example of an out of the money option

Jane owns shares of company X. The stock is currently trading at $50, but you think it will rise past $55 by the end of the week. Jane, however, does not think it’ll reach that price by then. You therefore ask her for the right to buy her shares at $55 at the end of the week, no matter what the price will be. Jane is willing to give you that right, but not for free, because she is taking a risk. She sells you the option to do that for $1 per share, which comes out to $100 in total. This call option is considered out of the money because the stock is currently trading at a market price that is below the $55 strike price.

There are now three possible outcomes:

You make money. Let’s say the stock is trading for $60 upon expiration. Your out of the money option is now in the money, and you have the right to buy Jane’s shares for $55. This represents a $5 discount from the current $60 market price. Pretty cool! You paid $1 per share, so you now have a profit of $4 per share. Since options are contracts of 100 shares, this amounts to a profit of: $500 - $100 = $400. If you had spent those $100 on two shares of stock, you would have a profit of $20.

You break even. If the stock is trading for $56 upon expiration, that’s $1 above your strike price, or a $100 profit. However, you paid $100 for the option. You therefore make $0. You don’t make money, but you don’t lose any either.

You lose money. If the stock price is trading below your $55 strike price by expiration, your option expires out of the money and is worthless. It wouldn’t make sense to exercise your right to purchase the shares for $55 when they are trading for less than that on the open market. As a consequence, you lose the entire $100 you paid for the premium. If, on the other hand, the price rises past your strike price to $55.5, that’s a profit of $50. Since you paid $100 for the option, that amounts to a loss of $50: $50 - $100 = -$50. In that case, you lose some of your investment, but not all of it.

The above example is an OTM call option. If it were a put option, you would need the stock price to fall below your strike price by the expiration date. A put option is out of the money as long as the price remains above the strike price.

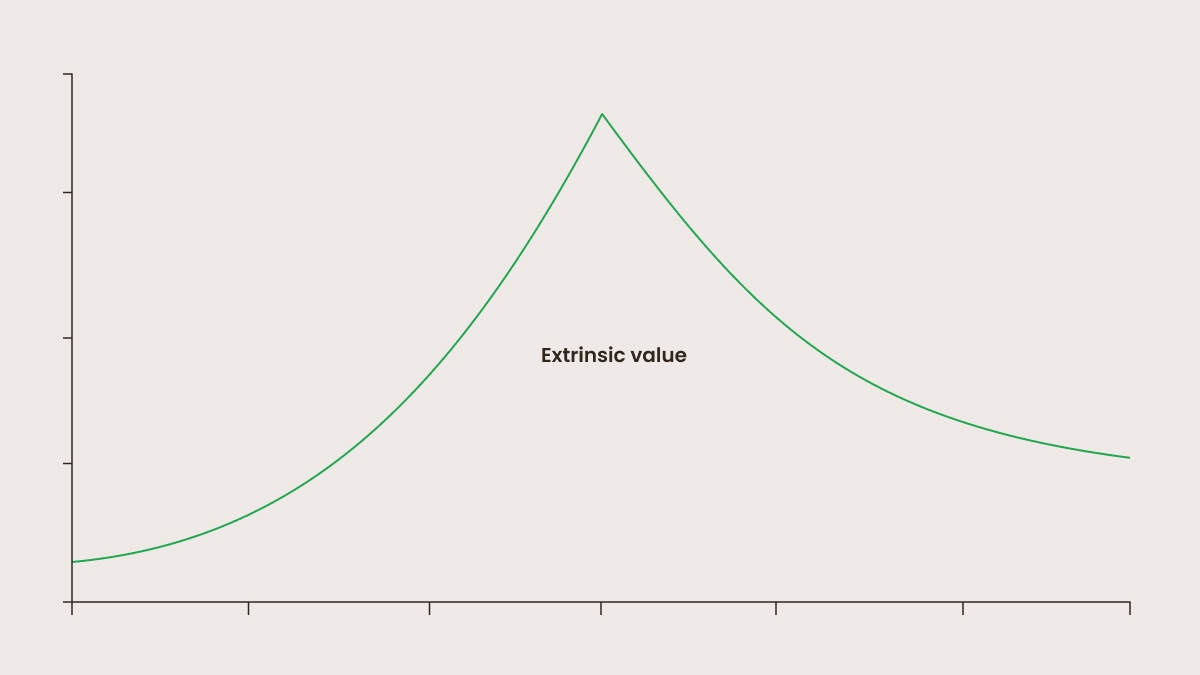

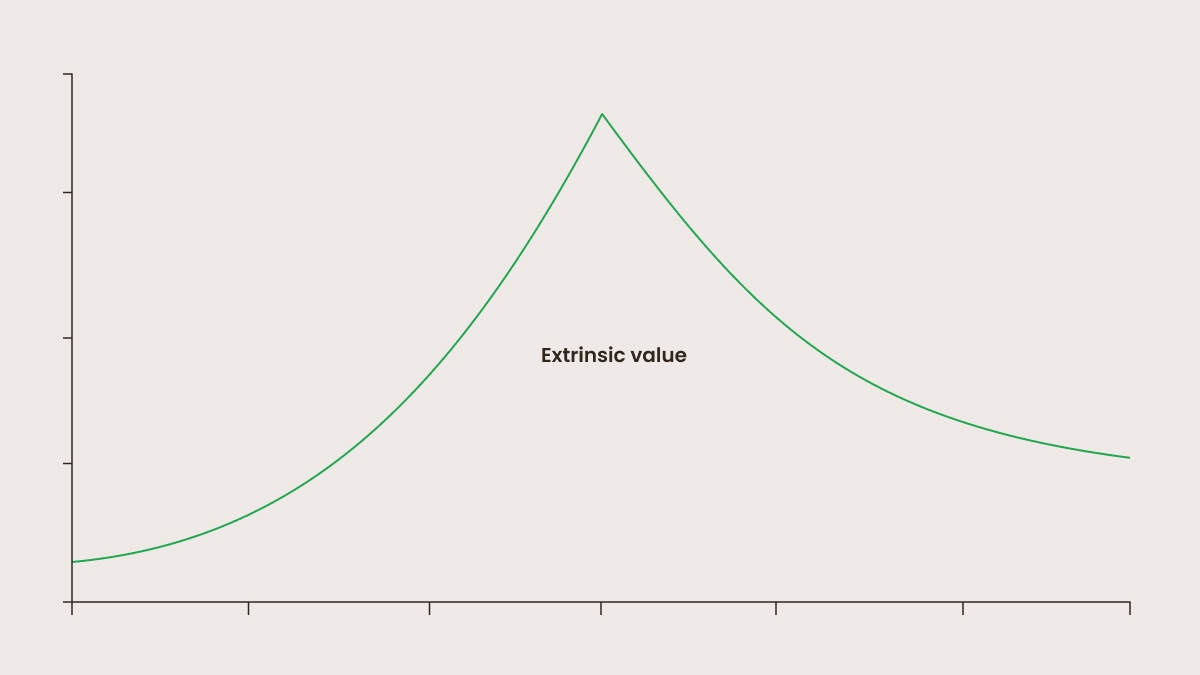

Extrinsic value

If an option is ITM by $10, it has $10 of intrinsic value. An OTM option, therefore, has only extrinsic value because the asset price is below the strike price. The pricing of an option’s extrinsic value will depend on a number of factors, but mostly implied volatility and time to expiration.

A stock that tends to be more volatile will have bigger price fluctuations, which means more opportunities to make a profit. Options will therefore be more expensive when a stock or the market is experiencing intense volatility. An option’s extrinsic value can be pricier in the lead up to certain events such as earnings reports or the release of important economic indicator data because of the volatility these are expected to create.

The time to expiration also plays a factor in price. An option will be more valuable if there is more time before it expires, because more time means more opportunities for it to get ITM.

Advantages of OTM options

Why would you pay for an option instead of just buying or selling shares normally? If you bought one share of a stock at $50 and sold it after it soared 10% to $55, you would be making a $5 profit. That sum is better than what you started with, but it won’t play a big role in your life. You would’ve had to buy many more shares of the stock for it to have a real impact on your finances, such as investing $500 to make $50, or $5000 to make $500. Not everybody has $5000 of spare cash lying around. Using an OTM option is a cheaper way to leverage and multiply your profits without actually owning the stock.