July 05, 2025

Psychology

Loss Aversion and Its Impact on Investment Decisions

No one likes to lose, so many traders go to great lengths to avoid loss. However, loss aversion is also responsible for most trading errors. Traders tend to pay more attention to potential losses than to equivalent gains, which damages their logical decision-making.

All market players, be they frenetic day traders or portfolio managers of larger institutions, occasionally see a red position on the screen. Losses are natural and cannot be entirely eliminated. What matters is that you know how to find the reason for the loss, and learn how to avoid it in the future.

Definition and origins

Loss aversion is a phenomenon discovered in 1979 by psychologists Daniel Kahneman and Amos Tversky as part of their Perspective Bias Theory – a treatise that transformed economic thought. Their studies showed that the psychological impact of losing $100 is far greater than the pleasure of acquiring the same amount. In other words, a person suffers more from a loss than they take pleasure from an equivalent gain.

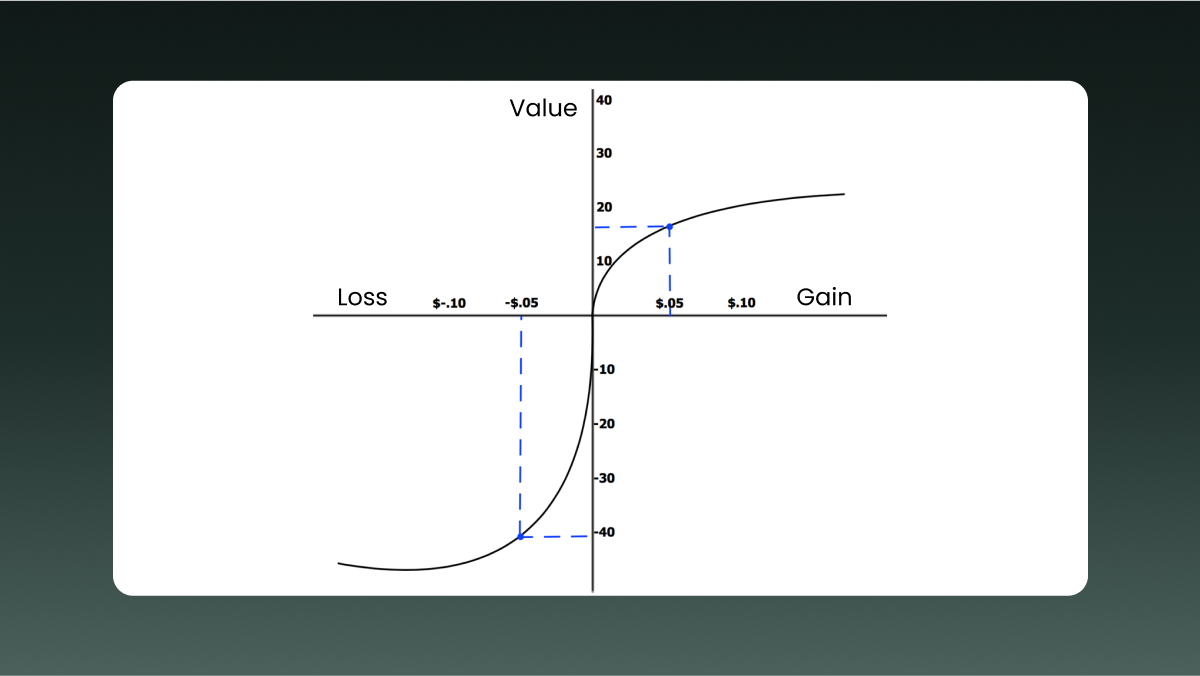

Their measurements of the asymmetry caused by loss aversion yielded an approximate two-to-one ratio:

The subjective value of the loss is approximately twice that of the corresponding gain.

Subsequent research has reproduced these findings across other cultures and asset classes, confirming the human mind’s persistence and depth of bias. We can see this asymmetry both on the screens of retail trading platforms and in the boardrooms of institutional investors. This asymmetry impacts asset allocation, risk budgets, and even macro-strategic allocations.

How loss aversion impacts investment decisions

At the portfolio level, loss aversion causes a disposition effect, where a trader tends to hold losers for too long and sell winners prematurely.

This distorts profit distribution over time and damages overall profitability. Additionally, this bias encourages excessive trading: when a trader closes an unprofitable trade, they enter more forced trades to repay the loss immediately. Such actions can lead directly to much deeper losses and extra commissions.

When traders are desperate to avoid regrets at all costs, the situation may get even worse. They may refrain from trading assets of innovative sectors, or assets that aren’t so popular in the community, since being wrong is unacceptable.

Institutional investors are no exception: risk committees reduce value-at-risk (VaR) limits for volatile markets not only because volatility is necessary, but also because they remember the agony of past falls. This damages portfolio diversification, limits possibilities, and lowers aggregate growth in the long run.

Examples in real-world trading

Holding on to a losing position

One common and vivid example is holding on to a losing position. An investor may keep an asset that has lost value, hoping it will eventually recover. This is called the “sunk cost fallacy.”

Selling means accepting a loss, and a loss is so hard to endure! As a result, the loser may hold on to losing shares for too long and sometimes suffer even bigger losses.

Taking profit too early

Loss aversion also causes traders to take small profits way too early. If you purchase an asset at $50, hoping it will go to $60, you can close your position at $55 because you fear this small profit will disappear.

When you fear losing more than you enjoy your gains, you may tend to close trades as soon as you see a modicum of profit, and miss out on more.

Risk aversion

Another example is when a trader does not take any risks, even if they are required. A trader may not enter a well-designed trade for fear of a loss, even if analysis predicts that achieving a profit is possible. This bias can lead to missed opportunities and lower returns.

Strategies to overcome loss aversion

While loss aversion is very natural and proven in multiple studies, there are some practical steps that you can take to limit its impact on your decisions. Pre-specified rules and discipline are crucial and necessary.

A rules-based investment plan encourages objectivity.

For example, a rule may state that if an asset price drops by 7% from where you purchased it, you would close the trade no matter what. On the other hand, you may apply take-profit or trailing stop concepts to lock in profit.

Tips that will help you minimize the impact of loss aversion

Use hard stop-losses and exit levels for every trade. A stop-loss order will automatically sell a position when it falls to a predetermined price, causing you to cut your loss instead of holding on to a losing trade because of hope or fear.

Follow your pre-determined exit rules to eliminate emotions from your decision making. You should always do what your plan tells you, not what your loss aversion dictates. Make your rules non-negotiable and stick to them. This will help you avoid all the inner conflicts that arise from your inability to accept loss in a losing trade.

Analyze every trade after completion. Determine whether fear of loss has affected your actions and reinforce good habits.

Diversify your portfolio to limit the impact of a single losing position.

Enforce discipline to overcome your loss aversion.

Cultivate self-awareness by maintaining a trading journal.

How a trading journal can improve your strategy

Use your trading journal to record:

Every trade.

Reasons for entering the trade.

Intended exit.

Your feelings.

If you document the reasons for your actions and their outcomes and review the journal once in a while, you will learn to recognize your behavior patterns, including the ones that you follow to avoid losses. For example, you may notice that you keep asking yourself if you should sell assets with a dropping price or lock in profits ahead of time. Recognizing habits like these is your first step toward eliminating them.

The takeaway

Мarkets reward discipline, not bravado. Loss aversion is part of human psychology, but stopping it from dictating each trade decision is possible if you understand the asymmetric importance of losses and gains and implement the tools and patterns that will help you limit the impact of loss aversion on your trading.

Sure, if you overcome this bias, you will not necessarily build a foundation for your future long-term profit. But this will eliminate one crucial factor that can damage your profitability.

Open an FBS account

By registering, you accept FBS Customer Agreement conditions and FBS Privacy Policy and assume all risks inherent with trading operations on the world financial markets.