What is risk in investing?

Risk in investing is basically the chance that things won’t go the way you wanted. You put money into something, expecting it to grow, but there’s always a chance it’ll go down the drain.

No matter how promising your desired investment looks, nothing comes with a guarantee. Even the safest assets can take unexpected turns. Markets are unpredictable by nature, and that’s what makes risk part of the deal. The good news? If you understand risk, you can actually make it work in your favor.

Types of financial risk

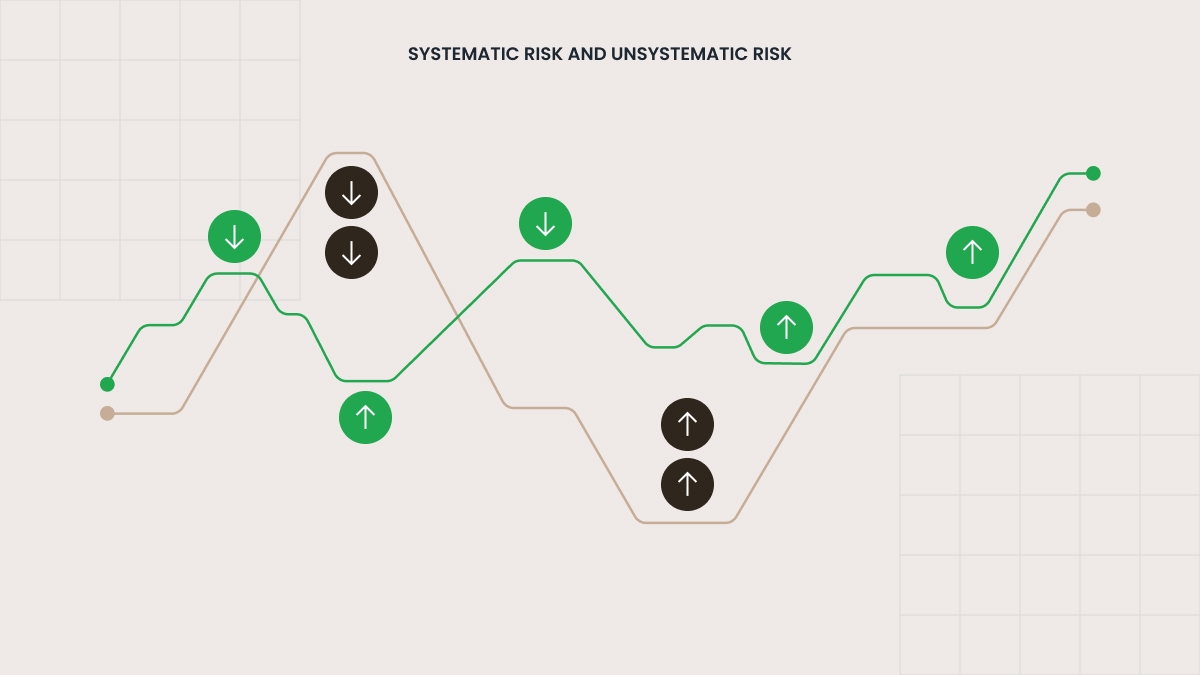

Systematic risks

These are risks you can’t avoid, no matter how diversified your portfolio is. They affect the whole market or large parts of it.

-

Market risk The classic one. Stocks go up and down, and sometimes they crash. This kind of volatility affects nearly everything in your portfolio, not just individual investments.

-

Interest rate risk Central banks move interest rates up or down, and when they do, it can hit your bonds or real estate investments hard. Sometimes even stocks feel the ripple.

-

Inflation risk If inflation eats away at your returns, your actual purchasing power shrinks even if the numbers in your account go up.

-

Currency risk If you invest in something tied to another country, swings in exchange rates can eat into your gains or deepen your losses.

-

Country risk Again, let’s imagine you’ve got money tied up in a company overseas. That company might be solid, but if the country it’s based in goes off the rails, your investment’s still taking a hit. It’s not always about the business; sometimes the whole environment shifts.

-

Geopolitical risk Things like military conflicts, sanctions, or sudden breakdowns in international relations can shake up the markets in ways you can’t really plan for. Investors tend to pull back fast when uncertainty spreads, and that can hit your portfolio even if you’re not directly exposed to the affected region.

-

Liquidity risk If no one wants to buy what you’re selling, you’re stuck. Assets that are hard to sell when you need cash can become a problem fast.

Non-systematic risks

These are risks tied to specific companies or sectors. However, you can reduce these with smart diversification.

-

Business risk Some companies just aren’t run well. Maybe the business model’s shaky, maybe they can’t keep up with competition, or maybe their products flop.

-

Operational risk Someone screws up an order, the software crashes, the wrong guy gets promoted. Whatever it is, even little things can mess with how a company runs. It’s not always dramatic, but it can still cost money if it slows things down or makes customers walk.

-

Legal and regulatory risk This is the kind of trouble that shows up in headlines. A company gets slapped with a fine, dragged into court, or blindsided by some new rule they didn’t see coming. Doesn’t matter if business is booming, one legal mess can throw everything off.

-

Credit (default) risk If a company can’t pay its debts, bondholders and lenders are in trouble. This is especially relevant for fixed-income investors.

-

Modeling risk Financial models are only as good as the assumptions behind them. If your forecast relies on a broken model, you might be in for a surprise.