Alternative investments cover a wide range of stuff, not your usual stocks and bonds. They each work a bit differently, so let’s run through seven of the main types and what makes them tick.

Private equity basically means putting money into companies that aren’t listed on the stock market. It could be a brand-new startup you think has potential (that’s called venture capital), or helping a business grow (growth capital), or even buying out a company completely.

Private debt is something else. You're not buying public bonds or anything traded on exchanges. Instead, you’re lending money to businesses directly, outside of the usual bank system.

Say a green energy company needs funds — they might issue private bonds to raise that cash.

Hedge funds are in their own category. They’re usually for wealthy individuals or big firms with strong returns. Some might trade stocks fast, some bet on where the market’s headed, others use fancy algorithms. It’s a whole smorgasbord.

Real estate is more familiar: investing in actual buildings, like houses, offices, or shopping centers. You can earn rental income, and if the property’s value goes up over time, that’s another win.

Commodities are all about raw materials like oil, gold, wheat, or gas. They’re heavily dependent on supply and demand, and people often see them as a way to protect your money when inflation kicks in.

Collectibles are more niche. These are things like vintage cars, fine art, rare wines, or sports cards. The upside can be big if you know what you’re doing, but it’s risky too — prices are unpredictable, and storing or maintaining the items can cost a lot.

Structured products are where it gets technical. These are investment tools built out of other financial assets often involving things like derivatives or bonds. You might’ve heard of credit default swaps or CDOs. Not exactly beginner-friendly, but they’re part of the landscape.

How to find alternative investments in 2025

If you’re exploring alternative investments, there’s no one-size-fits-all approach. Using a mix of strategies and staying proactive is key. That said, getting a solid grasp of private markets isn’t always easy. One way to learn? Get involved. Join industry events, online forums, or any space where people are talking about this stuff.

Thinking about getting into art trading, for example? It’s a very specific world. You’ll either need to really immerse yourself or talk to someone who is in the know. Going to art fairs, exhibitions, and auctions can give you a much better understanding.

For more traditional alternatives like real estate, private equity, or hedge funds, data and analysis are much more important. Investors in venture capital often rely heavily on analytics. Info on things like how startups are performing, who’s getting funding, and what’s trending in the market help guide where the money goes.

And if you’re just getting started, don’t wing it. Talk to people who’ve done it before. Whether it’s a financial advisor or a firm that focuses on alternative assets, getting advice early on can save you a lot of headaches down the line.

Advantages of alternative investment assets

More and more people are turning to alternative investments in 2025. They give your portfolio something different. Unlike regular stocks or bonds, these kinds of assets don’t always follow the same patterns, and sometimes they offer better returns. There can be some tax perks too, especially if you’re thinking long-term.

Private equity lets you invest in companies that aren’t on the stock market, which can be a great way to catch early growth.

And then there are the more niche investments like art, collectibles, or even crypto. They’re not for everyone, but for the right person, they can be both exciting and profitable.

Real estate or commodities can also help during inflation. As prices go up, these assets tend to hold their value, which is nice when your money is shrinking elsewhere.

Another trend picking up speed is impact investing. That’s where you put your money into causes you care about (like clean energy, education, or healthcare) and still aim for a return.

There’s also growing interest in investing in infrastructure like roads, airports, and so on. They tend to bring steady income over time.

Disadvantages of alternative investment assets

But here’s the thing: it’s not all upside. A lot of these investments come with higher fees, more risk, and they’re not as easy to sell when you need cash. So yeah, they’re interesting, but you’ve got to know what you’re doing.

A lot of alternative investments can be tricky to sell quickly.

Collectibles, for example, come with extra headaches like special storage or maintenance costs.

And let’s be honest: some of these investments are just complicated, especially when it comes to taxes or figuring out how to report them properly.

There’s also the transparency issue. Alternative assets don’t always come with the same level of oversight as regular investments, which can open the door to shady dealings if you're not careful.

That’s why doing your homework matters. Diversify, dig deep before committing, and when in doubt, talk to someone who really knows this space. A good financial advisor can save you a lot of trouble down the line.

How to invest in alternative assets

1. Know what you’re after

Are you in it for long-term growth? Passive income? Just trying to hedge against inflation? Whatever your reason, be clear about your goals and how much risk you can stomach. That’ll steer the rest of your decisions.

2. Dig deep

Once you know what you want, start reading a lot. Learn about the different types of alternative investments — real estate, private equity, art, and crypto. Get a grip on how each one works, and what could go wrong.

3. Don’t go it alone

These aren’t simple investments. Talk to someone who knows the space: a financial advisor, a fund manager, even a nerdy friend who's been through it. A bit of guidance now can save you a headache later.

4. Check the fine print

Some alternative investments are only open to accredited investors. That means meeting certain income or net worth thresholds. It’s worth checking the eligibility rules early on so you don’t waste time on options that are out of reach for now.

5. Make the move

Once you’re ready, invest. Whether through a platform, a fund, or directly into something physical. Just make sure you’re not putting all your eggs in one shiny basket.

6. Keep tabs on it

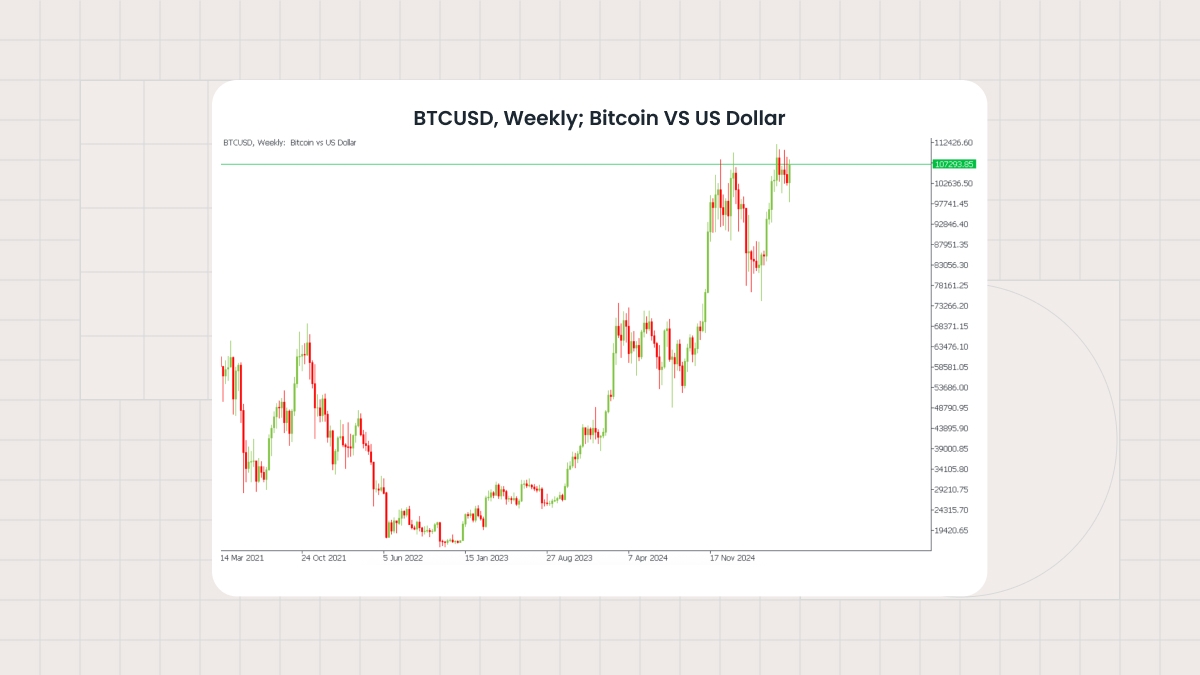

Alternative investments aren’t the kind you forget about for five years. You’ll want to check in, see how they’re doing, and tweak things if needed. Especially since markets change.

7. Have an exit plan

A lot of these assets aren’t easy to sell quickly. So think about when and how you might want to cash out, and what conditions would make that a smart move.

What are the best alternative assets to invest in?